does instacart take taxes out of paycheck

The amount they pay is matched. Along these lines the time-based compensation you procure from Instacart wont be the final sum you clear after taxes.

What You Need To Know About Instacart Taxes Net Pay Advance

So for every thousand dollars you earn the government gets 124 for Social Security and 29 for Medicare totalling 153.

. Does Instacart take out taxes for its employees. As an Instacart customer you are an independent temporary worker. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck.

I got my 1099 and I have tracked all my mileage and gas purchases but what else do I need to do before I file. If they make over 600 Instacart is required to send their gross income to the IRS. Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers.

If you are an independent contractor for Instacart follow the link here to find out more information regarding the deductions that can be claimed. When you work for instacart youll get a 1099 tax form by the end of january. If you pay attention you might have noticed they dont take that much out of your paycheck.

If youre required to pay 110 set your quarterly payments to 275 instead If your income goes up or your deductions are lower youll have a small April 15th tax. Report Inappropriate Content. Independent contractors have to sign a contractor agreement and W-9 tax form.

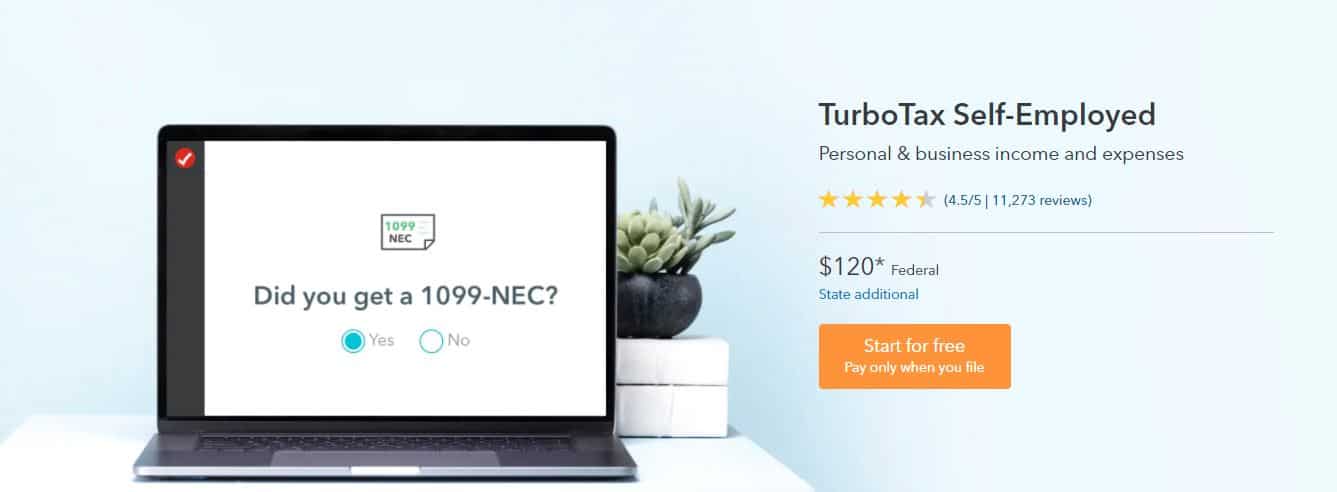

This is a standard tax form for contract workers. If you make more than 600 per tax year theyll send you a 1099-MISC tax form. Its a completely done-for-you solution that will help you track and.

For its full-service shoppers Instacart doesnt take out taxes from paychecks. Plan ahead to avoid a surprise tax bill when tax season comes. If youre wondering how Instacart pay these workers its on a W2 basis just like.

The withdrawal should be 25 of your previous years tax liability. Instacart says they pay mileage but apparently its not listed as a separate line item in issued paychecks so its really hard to tell. They will owe both income and self-employment taxes.

They do not pay at all for miles traveling to the store to begin shopping. Part-time employees sign an offer letter and W-4 tax form. You do get to take off the 50 ER portion of the SE tax as an adjustment on line 27 of the 1040.

Because instacart shoppers are contractors the company will not take taxes out of your paycheck. This implies you need to cover all your own costs and pay your own taxes. For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year.

For 2021 the rate was 56 cents per mile. This rate covers all the costs of operating your vehicle like gas depreciation oil changes and repairs. You pay 153 SE tax on 9235 of your Net Profit greater than 400.

You can deduct a fixed rate of 585 cents per mile in 2022. You dont send the form in with your taxes but you use it to figure out how much to report as income when you file your taxes. Fill out the paperwork.

Social Security tax is 124 of your pay. This means that you have to cover all your own expenses and pay your own taxes. Everybody who makes income in the US.

Register your Instacart payment card. Has to pay taxes. Also known as FICA tax its how freelancers and independent contractors contribute to Social Security and Medicare.

Youve now met your estimated tax obligation by paying 100 of your previous years tax liability. I worked for Instacart for 5 months in 2017. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store.

But when youre running a side hustle youre in charge of paying your own taxes. The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. When you make money as a traditional 9-5 employee the employer is in charge of taking taxes out of your paycheck.

As part-time workers in-store shoppers will have taxes automatically withheld by Instacart when they are paid. Medicare is 29 of your pay. You do get to take off the 50 er portion of the se tax as an adjustment on line 27 of the 1040.

The Standard IRS Mileage Deduction. Its typically the best option for most Instacart shoppers. Download the Instacart app or start shopping online now with Instacart to get groceries alcohol home essentials and more delivered to you in as fast as 1 hour or select curbside pickup from your favorite local stores.

Tax Implications of Working for Instacart. Side note Im an idiot who didnt want to pay taxes out of pocket so I canceled 10 Instahours and decided to Instaquit. To pay your taxes youll generally need to make quarterly tax payments estimated taxes.

What taxes do full-service shoppers have to pay. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. However Instacart does accept most American and Canadian debitcredit cards as well as some third-party payment options like PayPal Google Pay and.

Instacart shoppers are contractors so the company will not deduct taxes from your paycheck. To make saving for taxes easier consider saving 25 to 30 of every payment and putting the money in a different account. You can save 25 to 30 of every payment and put it in a different account to make saving for taxes easier.

You pay 153 se tax on 9235 of your net profit. W-2 employees also have to pay FICA taxes to the tune of 765. Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may also be subject to tax.

Unlike in-store shoppers Instacart delivery drivers have to pay self-employment tax. Heres how it works. Instacart does not take out taxes for independent contractors.

The estimated rate accounts for Fed payroll and income taxes. Instacart shoppers use a preloaded payment card when they check out with a customers order. So you get social security credit for it when you retire.

There are a few different taxes involved when you place an order. Tax withholding depends on whether you are classified as an employee or an independent contractor.

How To Avoid An Irs Audit As An Uber Or Lyft Driver In 2021 Lyft Driver Audit Irs

How Much Of My Earnings Doordash Grubhub Uber Eats Etc Is Taxable

Instacart Pay Stub How To Get One Other Common Faqs

How Much Should I Set Aside For Taxes 1099

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Is An Employer Allowed To Stop Taking Federal Taxes Out Of My Paycheck So That I Can Take Advantage Of A Tax Credit Quora

This Post Will Walk Through The Fourth Report In Bluegranite S Power Bi Showcase A Series Desig Employee Retention Data Visualization Machine Learning Models

What You Need To Know About Instacart Taxes Net Pay Advance

How Much Of My Earnings Doordash Grubhub Uber Eats Etc Is Taxable

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

20 Popular Canadian Tax Deductions And Credits In 2022 2022 Turbotax Canada Tips